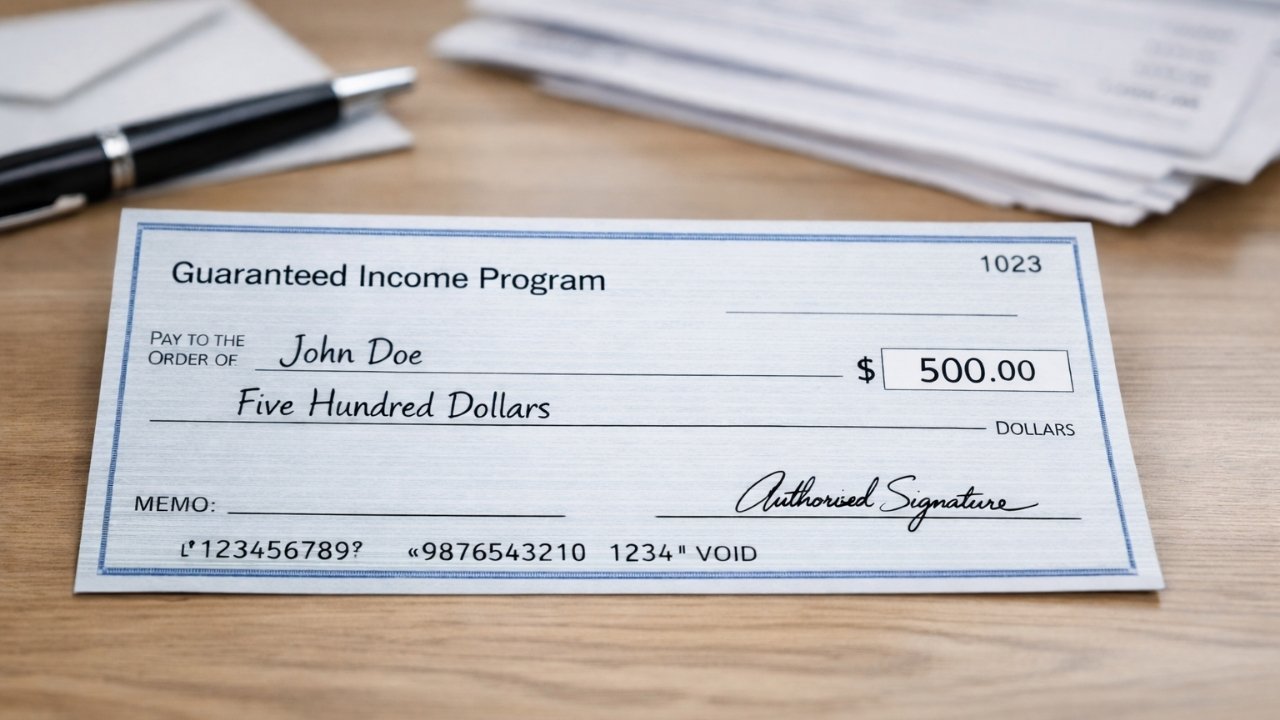

The U.S. Guaranteed Income Program has emerged as a modern policy tool to address income instability among low- and moderate-income households. Instead of providing benefits tied to strict conditions, this approach offers direct monthly cash payments that recipients can use for their most immediate needs. One of the most widely discussed models provides $500 per month to eligible individuals or families.

In recent years, these programs have gained attention as rising housing, food, and utility costs continue to pressure household budgets. Mainly backed by temporary federal funding introduced during the pandemic, the U.S. Guaranteed Income Program has become a closely observed example of how unconditional cash support works in real-world conditions.

JUST IN: Cook County Approves MASSIVE Permanent “Free Cash” Program

Cook County, Illinois — the second-largest county in America — just voted UNANIMOUSLY to make guaranteed income permanent, handing out $500–$1,000 a month in taxpayer-funded cash with zero strings attached.

— Tony Lane 🇺🇸 (@TonyLaneNV) November 29, 2025

Table of Contents

Understanding Idea Behind Guaranteed Income

Guaranteed income programs are built on a straightforward principle. Eligible participants receive a fixed cash amount at regular intervals, with no work requirements or spending restrictions. The intent is not to replace employment or long-term welfare systems but to provide a reliable financial buffer that helps households manage essential expenses.

Unlike traditional assistance programs, guaranteed income does not dictate how funds must be used. Participants decide how best to allocate the money based on their circumstances. This flexibility acknowledges that households face varying financial pressures across periods, and a uniform approach may not adequately address these realities.

Role of American Rescue Plan Act in Funding Programs

A major driver behind the expansion of guaranteed income pilots was the American Rescue Plan Act (ARPA), enacted in 2021 as part of the federal response to the economic impact of the COVID-19 pandemic. The American Rescue Plan Act (ARPA) provided substantial funding to state and local governments, granting them broad flexibility in how they used it.

Local governments were permitted to use ARPA funds for programs that addressed economic hardship, income loss, and financial insecurity. This flexibility made ARPA an ideal funding source for guaranteed income initiatives, including monthly cash payments to residents most affected by economic disruption.

Because ARPA funds were available for only a short time, governments were more likely to test new ideas rather than commit to long-term programs immediately. Guaranteed income pilots funded through ARPA enabled policymakers to gather data, assess outcomes, and evaluate whether direct cash assistance could be an effective tool to improve financial stability. In several cases, early results have informed discussions about whether to continue or locally fund these programs after ARPA funds expire.

How the $500 Monthly Model is Designed

The $500 per month structure has been widely adopted because it represents a balance between meaningful support and budgetary practicality. The amount is sufficient to help cover recurring expenses while remaining manageable within limited pilot budgets.

Programs funded through ARPA typically operated for fixed periods, often between one and two years. Payments were delivered monthly through direct deposit or prepaid cards, ensuring predictability and ease of access for participants.

| Program Feature | General Description |

|---|---|

| Monthly Payment | $500 per eligible household |

| Payment Frequency | Once per month |

| Usage Rules | No restrictions on spending |

| Typical Duration | 12 to 24 months |

| Selection Method | Application followed by random selection |

This structure helped administrators focus on outcomes rather than enforcement, while participants benefited from consistency and clarity.

Eligibility Criteria and Participant Selection

Although guaranteed income programs share common principles, eligibility rules vary by local priorities and funding guidelines. Most ARPA-funded programs targeted households with incomes below specific thresholds, often tied to local median income or federal poverty guidelines.

Common eligibility elements include the following.

- Residency within the sponsoring city or county

- Minimum age requirement, usually 18 years or older

- Household income below a defined income cap

Application periods were generally open for a limited time. When demand exceeded available slots, random selection methods were used to ensure fairness and avoid bias.

How Participants Typically Use the Monthly Payments

Data collected from multiple guaranteed income initiatives shows consistent spending patterns focused on essentials. Participants overwhelmingly report using funds for necessities rather than discretionary purchases.

Typical uses of the payments include the following.

- Housing-related expenses such as rent, utilities, or home maintenance

- Food, transportation, healthcare, childcare, and emergency needs

The unrestricted nature of the payments allows households to respond quickly to unexpected costs, reducing reliance on high-interest debt or emergency borrowing.

Economic and Social Impacts Observed

Evaluations of ARPA-funded guaranteed income pilots show improvements in short-term financial stability. Participants often report lower stress levels, greater confidence in meeting monthly obligations, and improved planning ability.

From a broader perspective, guaranteed income payments tend to circulate within local economies. Spending funds on everyday goods and services supports small businesses and community economic activity. Importantly, program data have not shown reductions in employment participation among recipients.

How Guaranteed Income Differs From Traditional Assistance

Traditional assistance programs often involve detailed reporting requirements, eligibility reviews, and spending restrictions. Guaranteed income takes a different approach by prioritizing simplicity, trust, and recipient autonomy.

The U.S. Guaranteed Income Program model reduces administrative burden for governments while providing participants with immediate, flexible support. This efficiency has made guaranteed income an appealing option for local governments seeking responsive solutions during periods of economic uncertainty.